On the Spot: Inflation Update Inbound

Market run-through

Depending on your standpoint, the markets enjoyed or endured a very quiet week last week. The combination of a lack of top-tier data and a surfeit of Turkey and Pumpkin Pie in the US put paid to any energy that there may have been. With this background, it was no surprise that the currency markets traded sideways, with action postponed to this week. The data released included worldwide diffusion indexes in the shape of PMIs, which were, broadly speaking, slightly better than expected; however, it must be noted that Germany increasingly looks like the sick man of Europe again with an economy that is the best flatlining. The UK populace received its Autumn Budgetary Statement from Chancellor Hunt, where, somewhat surprisingly, he pulled the veritable rabbit out of the hat through tax cuts, including a larger-than-expected cut in National Insurance. The pound certainly liked the Chancellor’s moves, touching a ten-week high against the greenback, but possibly because they are seen as inflationary and will force the Bank of England to leave rates higher for longer than expected; only time will tell.

Talking of inflation this week, we get the latest prints from both the US and the Eurozone, which are expected to be benign and continue to head in the right direction. The US is, without doubt, heading for the fabled land of slow, soft landings, and a monthly print of 0.2% will continue to encourage these thoughts and dollar bears. The Eurozone’s numbers are expected to be closer to 4% on core and headline at 2.6%. We will also be keeping an eye on month-end flows from midweek, which are expected to be dollar negative, and developments in the geopolitical world. Finally, if you enjoy these notes and wish to discuss them in more detail, please feel free to contact me at r.matthews@one.io

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

Infringements in the crypto industry have been at the forefront of news recently. European Central Bank President Christine Lagarde shares her views: “People are free to invest their money where they want, people are free to speculate as much as they want, people should not be free to participate in criminally sanctioned trade and businesses.” Recent news saw a 4.3B settlement from Binance as part of a plea arrangement with the government. This was the largest penalty in US Treasury history. Binance CEO Changpeng Zhao, known as CZ in the industry, was also given a hefty fine of 50M USD as he pleaded guilty to failure to protect against money laundering. Many crypto supporters saw the decision by authorities not to shut down Binance as a victory for the sector. The price of BTC seemed relatively unaffected by this news breaking as well, but BNB, Binance’s in-house currency fell roughly 15% on the news.

We can also note that the United Securities and Exchange Commission sued Kraken, one of the largest cryptocurrency exchanges in the world, on allegations that they mixed customer funds and failed to register with the regulator as a securities broker, dealer, and clearing agency. Kraken responded calling the SEC view of digital assets “incorrect as a matter of law, false as a matter of fact, and disastrous as a matter of policy.” Once again, the industry was comforted by the news that the lawsuit would not affect the more than 10 million clients serviced by the exchange.

Last week on ONE’s OTC trading desk, we saw a slight decrease in BTC trades. This could be a result of BTC’s price stalling around 37,000 USD. We did however see BTC break over 38,000 USD for the first time since May 2022, with BTC bulls holding firm into the weekly close, although this has slightly retreated since then. As BTC eyes 40,000 USD, it will be interesting to see what this week brings.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

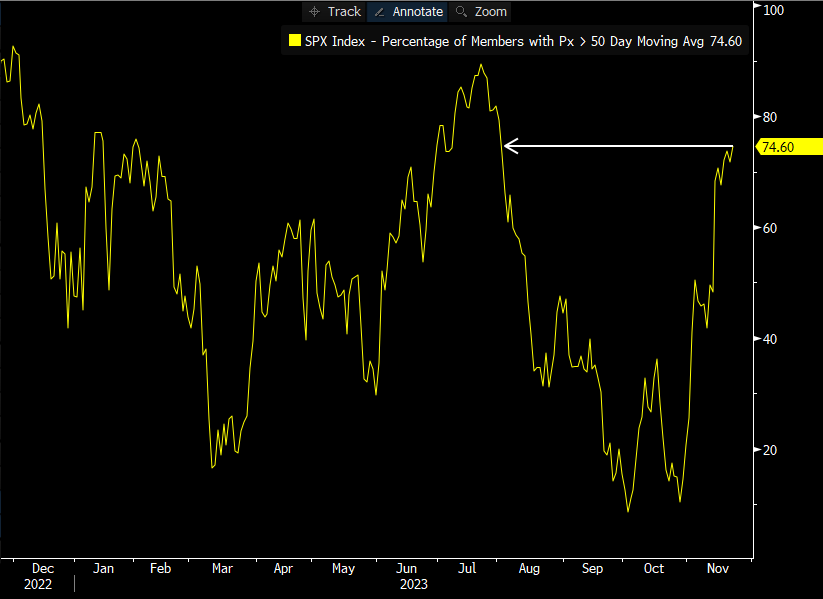

Unsurprisingly, the holiday-shortened week has resulted in relatively benign trading conditions across the financial markets. Nevertheless, risk appetite has remained relatively firm, with the S&P 500 set for a fourth straight weekly advance, the index’s best run since mid-June. While the technology sector continues to outperform, even after modest market disappointment at Nvidia’s earnings, there are increasing signs that gains are beginning to be spread more widely across the index. For instance, the percentage of S&P constituents trading above their 50-day moving average has risen to almost 75%, the highest since August, implying a significant improvement in market breadth in recent weeks. With seasonal trends remaining favourable, and a significant amount of cash remaining on the sidelines in money market funds, better breadth may be the catalyst markets need to further build on the recent advance.

Michael Brown, Market Analyst at Pepperstone

The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.