On the Spot: Don’t Buck the Buck

February 05, 2024

Market run-through

Both the US Federal Reserve and the Bank of England disappointed the more optimistic players in the markets this week. The Bank of England was not as dovish as markets had been expecting and even had two members of the Monetary Policy Committee voting for a further 25bp hike. However, this was partly offset by the perma dove Swati Dhingra voting for a cut. It became clear that the bank would be as hesitant to cut as it was to hike. Indeed, it is difficult to see problems ahead when looking in the rear-view mirror. With inflation having accelerated rapidly on Andrew Bailey’s watch, the reluctance to cut is understandable, and the politician in him may be waiting for the March Budget. In a way, Chairman Powell faces a similar problem and is also urging caution, and after Friday’s mega employment report, it’s not hard to see why!

As Michael Brown argues, it’s hard to find a convincing argument to be short of the mighty buck at the moment, and with what looks like a quiet week ahead and famous last words, this should continue to be the case. In terms of data, only ISM diffusion indexes are released this afternoon. There are, of course, machinations in the background to the markets to watch out for, and there could be further repercussions for the slightly higher than expected Quarterly Refunding announcement and, as importantly, the ending of the BTFB, which the Fed introduced after the collapse of Silicon Valley Bank. With the market still digesting the recent central bank meetings and last Friday’s data, there should be some volatility, but as always, we will be here to help guide you.

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

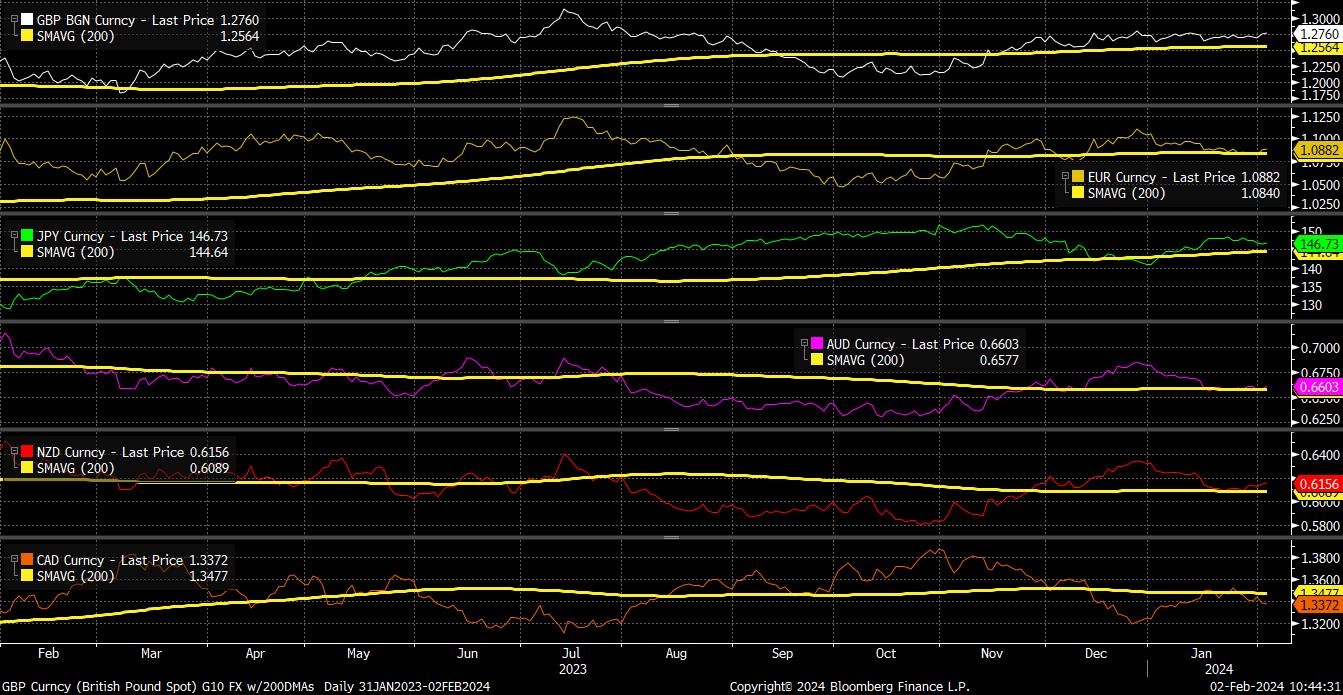

As frequent followers of mine will probably be aware, I don’t tend to go a bundle on technical analysis – be that chart patterns, Elliott Waves, or even the Chinese zodiac signs that someone on Bloomberg TV was trying to use as rationale to justify a rally in Hong Kong equities last week! One thing I am a fan of though, is the common-or-garden moving average, particularly the 200-day variety, given its strong tendency to signify changes in the longer-run market trend, particularly in the FX market. On this note, it’s interesting that the vast majority of G10s trade at, or very close to, those fabled yellow lines of the 200-DMA, despite the FX space having been relatively quiet of late. In any case, these are important levels to keep on the radar, particularly if some or all were to break, as said breaks would likely signify the next leg higher in the bullish USD trend that has been dominant at the start of 2024. When that technical backdrop is coupled with Fed Chair Powell’s pushback on the idea of a March cut at Wednesday’s FOMC, and the ongoing ‘goldilocks’ macro landscape as the economy cruises towards a ‘soft landing’, it still seems tough to justify betting against the buck.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.