On the Spot: Busy Week Ahead

January 29, 2024

Market run-through

Two down and two to go in the major central bank meetings we follow. Neither the Bank of Japan’s meeting last Tuesday nor the ECB’s on Thursday delivered any surprises. The BoJ maintained its steady-as-she-goes policy, and with Japan still recovering from the recent earthquake, this was entirely as expected. The market now goes back to one of its favourite games of trying to second guess when Governor Ueda will change policy; indeed, I was tempted by a bet that the BoJ will raise rates before any of the other central banks drop theirs. Tempting as it was to have a wager on that bet, the person offering the odds has a wiser head than I.

The ECB also followed suit and held steady despite mounting evidence, particularly in Germany, that economies are rapidly cooling. Christine Lagarde, as usual, gave a tedious press conference, the highlight being when one brave journalist asked how it felt to be so unpopular with your staff.

This week, the remaining big two get their turn in the spotlight. The BoE has arguably the more challenging job of the two. With signs of an impending recession growing, they should be considering cutting rates, but with inflation ticking up in December, they will have to stick with their higher-for-longer stance. Before the Old Lady stands up, the US Federal Reserve gets its opportunity to speak.

With GDP growth still robust, unemployment historically low and inflation still over target, there is no chance that the Fed will ease rates at this meeting. Recently, markets have been paring back their forecasts to nearer 100bp of cuts in the second quarter, which still looks a bit optimistic. Indeed, with the economy so strong some folk are looking for one more hike.

Without a doubt, Chairman Powell will be very cautious with his words at the press conference, having been misinterpreted after the December 13th meeting, which led to a rapid appreciation of asset prices. We will also be watching the Quarterly Refunding Announcement, which could exert as big an influence on the market as Jay Powell’s wise, considered words, and Non-Farm Payrolls on Friday.

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

“What a boring week!” Sometimes that’s a good thing in the world of cryptocurrency. The recovery from the dip below $40,000 is indeed a notable event for many investors, and we seem to be holding nicely. The dip below $40,000 definitely woke the bears, with speculation about the potential for BTC to drop further, as low as $30,000 in upcoming months. There is still a very positive outlook as the success of BlackRock’s Bitcoin ETF, reaching $2 billion in assets under management, is a significant milestone, highlighting the growing interest in cryptocurrency investment products among institutional investors.

On the trading desk, stables were the flavour of the week. Could this decline in trading volatile assets suggest a preference for stability during a period of uncertainty? With many people off-ramping into EUR, you can imagine the volatility as we waited for news from the European Central Bank (ECB), which turned out to be what most expected, dovish remarks from President Christine Lagarde.

The anticipation of further high-impact news in the upcoming week adds an additional layer of complexity to the market dynamics, as investors try to gauge how these events might impact cryptocurrency prices. It’s always interesting to see how the crypto market responds to various news and events. Keep an eye on the market trends and news updates, as they can play a crucial role in shaping the trajectory of cryptocurrencies.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

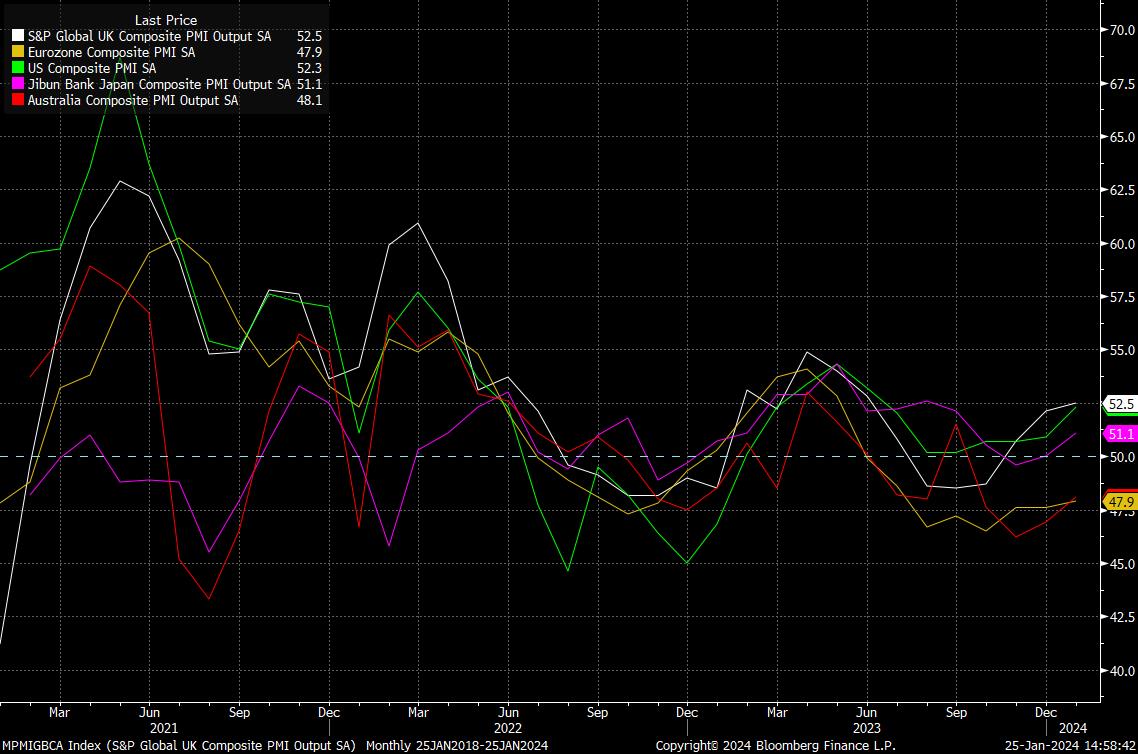

This week has seen the release of the latest ‘flash’ PMI surveys from most major economies and, for once, they have brought some good news for UK PLC. While the composite output gauges have seen a modest uptick across most developed markets, it is the UK where the pace of output growth is presently the fastest, perhaps dispelling some of the ‘doom and gloom’ that has dominated the economic outlook here in Blighty – and which your scribe has at times been guilty of – over the last year or so.

Clearly, the UK economy is far from ‘out of the woods’, with inflation remaining sticky, and signs of stalling consumer spending beginning to emerge. However, if the UK is able to maintain this relative growth outperformance, the GBP may well manage to remain underpinned, with the ‘Old Lady’ thus more likely to maintain rates at present levels than G10 peer, likely providing particular support in the crosses, such as EUR/GBP.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.