On the Spot: Beware the Ides of March

March 11, 2024

Market run-through

The dollar eased back markedly last week, mainly in response to Chairman Powell’s testimony to Congress, which was widely perceived as dovish. As always, with a speech from a central banker, the words are open to interpretation, and the temptation is always to hear what you want to hear, which the markets duly did. The general message from Powell was one of caution and to wait and see what the data brings with regards to inflation and data, which brings us neatly to last Friday’s Non-Farm Payroll figures, which, despite a strong headline, did show signs of weakness.

The other main event last week was the ECB council meeting, which was probably most notable for yet another tedious press conference. Christine Lagarde is a practised at saying a lot and nothing at the same time. If the ECB had a message similar to the one that her American counterpart delivered, that more data is needed when it comes to rate cuts. Unusually, sterling benefited from the dollar’s weakness and closed the week trading around its best levels for seven months.

Tomorrow’s UK wage data may decide whether the pound can stay at these giddy heights, which has been a major concern to the Bank of England. We could see some easing in the private sector, but state pensions increase from April, as do other state benefits which will temper the general slowdown. With an election looming, the Old Lady’s window to cut rates is closing, as the last thing Andrew Bailey needs, is to be painted as political. GDP is also released in the UK but has hardly been the most stable data series recently.

Tomorrow, the release of the Core Consumer Price Index in the US is expected to have cooled a bit to 0.3%. Whatever glasses you look at it through is still hot for the Fed even to start thinking of a cut. Retail sales are also published, and they should be healthier now that the wicked winter weather has retreated. Just one point to watch out for is that yesterday was the anniversary of the peak of the dot com bubble in 2000 and Friday is the Ides of March, hopefully just a coincidence! Have a great week!

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

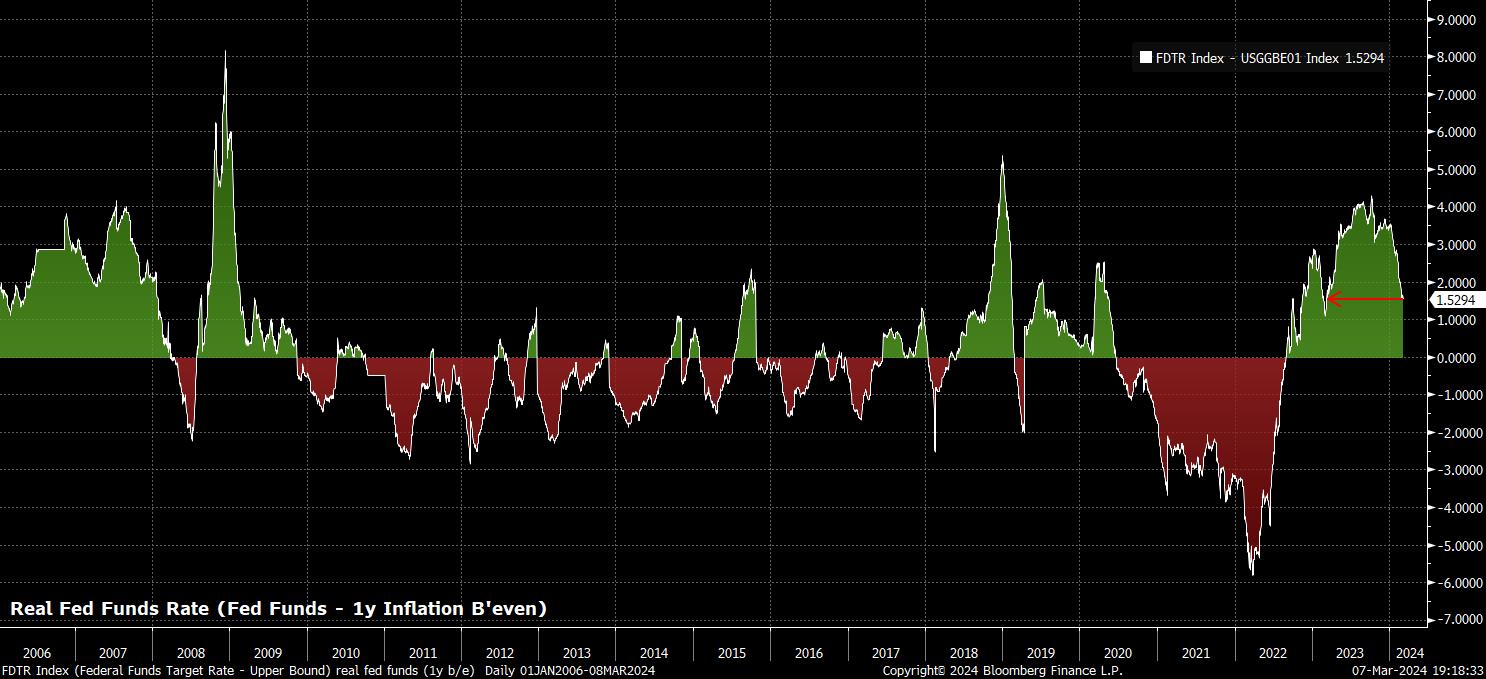

Market participants have, yet again, spent much of the last week continuing to guess, and second-guess, the policy path that the FOMC are likely to take during the remainder of the year, with the first 25bp cut still foreseen for the June meeting. However, looking a little deeper, there are some signs beginning to emerge that the FOMC may, in fact, not need to cut as soon as that, or as rapidly as market price.

The real fed funds rate, as measured by Chair Powell’s preferred measure which uses the 1-year inflation breakeven rate, has fallen to a 12-month low, implying that policy is in fact getting looser, not tighter, in turn lessening the need for cuts in the near term. If the market is doing the Fed’s job for them, why would policymakers seek to deliver rapid cuts to the overnight rate? This, in short, poses the biggest risk to the supportive policy backdrop for risk sentiment, in that the prolonged easing cycle back to neutral that markets currently price, could turn into a short and shallow cutting cycle akin to the late-90s.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.