On the Spot: A Busy Week Ahead

June 03, 2024

Market run-through

After two holiday-shortened weeks, we return to a whole week of trading today and an interesting few days ahead. After Friday’s PCE deflator came in slightly softer than expected, the dollar began to sell off from its recent levels and tested significant support levels on the dollar index. US bond yields also backed away; whether these moves were exaggerated by month end we will see over the next few days. As it’s the first week of the month, the US Labor Department will release employment statistics throughout the week, starting with Job Openings (Jolts) on Wednesday, which doves hope to see drop from the 8.488 million level. The highlight is Non-Farm Payrolls on Friday, which are expected to show a gain of 175,000. Any weakness in the number will be taken as further encouragement by those praying for a cut in rates by the Fed.

We definitely won’t be hearing from any Fed officials this week as they are in their blackout period ahead of their next meeting on 11th-12th June. However, we will hear plenty from the ECB council after their meeting on Thursday and almost certainly see a rate cut of 25bp. The move has been consistently telegraphed, and it would be a major surprise if it fails to materialise. Until the back end of last week, the cut was widely expected to be rapidly followed by more cuts, possibly even back-to-back moves. However, headline inflation increased from 2.4 to 2.6% in May, while core inflation increased from 2.7 to 2.9%. Indeed, the numbers were hotter than expected and should encourage the hawks on the council to temper the doves’ enthusiasm for loosening the brakes on the economy. With this in mind, we expect a hawkish cut with Christine Lagarde’s press conference urging caution.

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

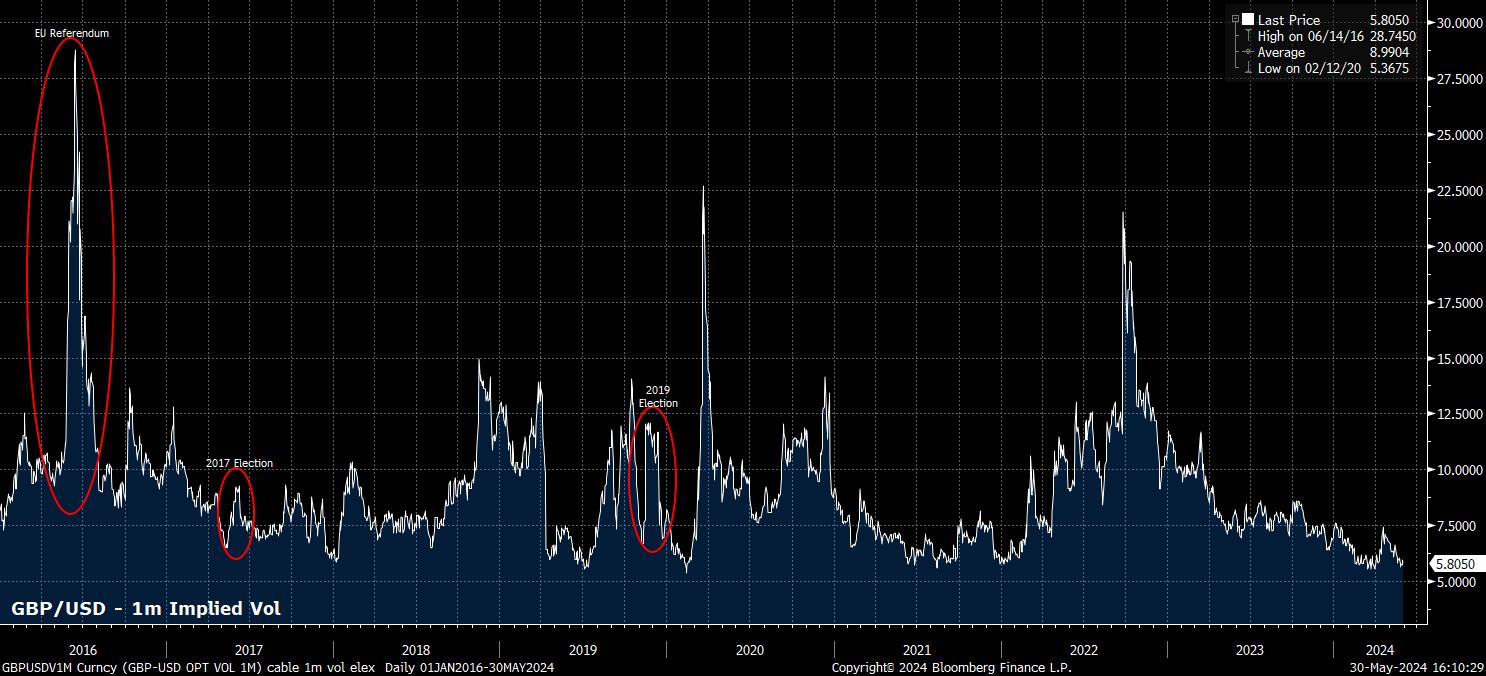

There are still just under 5 weeks of the general election campaign to go, news that will likely be rather concerning to some, particularly given the already-tedious nature of political news flow. Nevertheless, while current opinion polling would suggest the election result – namely, a sizeable Labour majority – is something of a foregone conclusion, market participants do seem likely to increasingly engage in hedging activity, in turn resulting in higher GBP implied vol, as polling day nears. Principally, this hedging will relate to the two major tail risks – the upside risk of a Tory majority, and the downside risk of a hung parliament. As this week’s chart shows, previous polls have seen vols move higher in the run up to election day, though perhaps any rise in vol this time around may be to a lesser extent than in recent times, particularly with room to manoeuvre on the fiscal front so limited, with both major parties subscribing to the same set of OBR ‘fiscal rules’.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.