On the Spot: Timing is Everything

March 19, 2024

Market run-through

As my friend Michael Brown writes eloquently in his column below, the markets received a couple of shocks last week from hotter-than-expected inflation data in the US. The prices data may cause a recalibration in the dot plot and higher US 10-year yields, but so far, it has done nothing to dampen the enthusiasm of the S&P 500 fans. Elsewhere, despite the ongoing war in Ukraine, the Russian voter carried on voting for Vladimir Putin, re-electing him again with a record 87.8% of the vote. Reinforcing Putin’s power will undoubtedly embolden him further, which is hardly good for Europe or its markets. FX markets have been somnolescent recently, turning a blind eye to pretty much everything and seemingly enjoying an early spring break. Maybe this week’s plethora of central bank meetings will awaken currency traders.

Once the Fed meeting concludes on Wednesday, our attention will turn to Threadneedle Street, where the Bank of England will hold its Monetary Policy Committee meeting, which finishes on Thursday. Central banks worldwide are finding the inflation genie is proving challenging to keep in the bottle, and the BoE is no different. The latest data for UK price data is published on Wednesday, making for an interesting debate between the hawks and doves and the key point to watch for is whether the two perma hawks, who voted for a rate hike at the last meeting, have thrown in the towel. There is little or no chance that the Old Lady will cut this time around. However, if their preferred measure of inflation (services CPI) dips meaningfully below the predicted 6%, speculation of a cut in June will grow, putting pressure on cable. How the Bank could square-cutting rates with inflation at three times its target level is beyond me, and wiser heads than mine see the first cut coming in September if disinflation continues. But, and there is always a but, the imponderable is when the UK election and the subsequent impact on the timing of any reduction in interest rates.

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

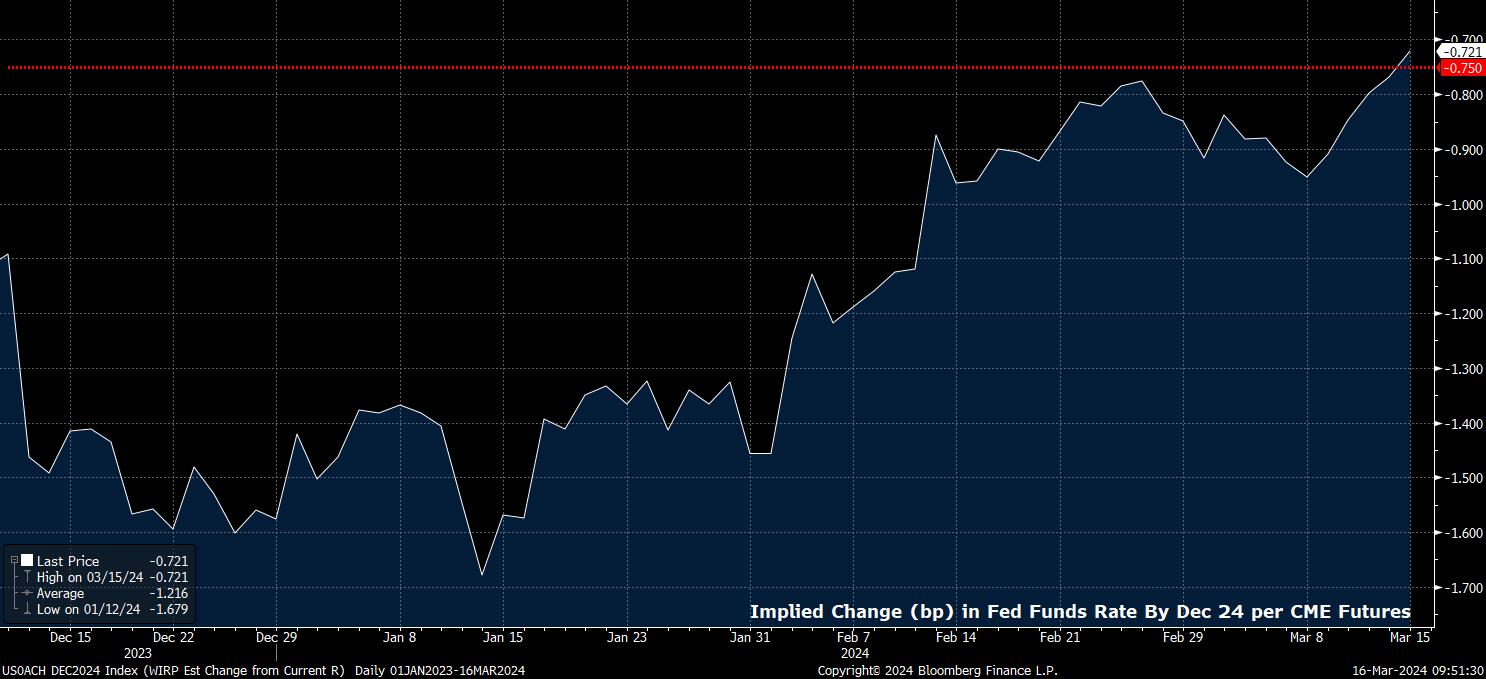

Market participants have, yet again, spent much of the last week continuing to guess, and second-guess, the policy path that the FOMC are likely to take during the remainder of the year, with the first 25bp cut still foreseen for the June meeting. However, looking a little deeper, there are some signs beginning to emerge that the FOMC may, in fact, not need to cut as soon as that, or as rapidly as market price. The real fed funds rate, as measured by Chair Powell’s preferred measure which uses the 1-year inflation breakeven rate, has fallen to a 12-month low, implying that policy is in fact getting looser, not tighter, in turn lessening the need for cuts in the near term. If the market is doing the Fed’s job for them, why would policymakers seek to deliver rapid cuts to the overnight rate? This, in short, poses the biggest risk to the supportive policy backdrop for risk sentiment, in that the prolonged easing cycle back to neutral that markets currently price, could turn into a short and shallow cutting cycle akin to the late-90s.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.