On the Spot: Seventies Rerun on the Agenda?

January 15, 2024

Market run-through

Despite central bank expectations and, indeed, wishes, inflation is far away from being dead and buried, and last Thursday’s figures confirmed this when US CPI came in at 3.4%, above the market’s best call; when taken in isolation, one set of figures doesn’t set policy any more than one swallow doesn’t make a summer.

But when the Fed is data dependent, and inflation is more robust than expected, as is employment, one must question whether the forecast cuts in the US will actually materialise.

As we said last week, the markets do feel that they have got ahead of themselves, and with tensions still rising in the Middle East, the chances of an oil price shock similar to the one in 1973 that followed the Yom Kippur War can’t be totally discounted. This would truly be pouring petrol on the fire.

This week, we get to see further information on the US economy in the shape of retail sales released on Wednesday. The markets expect a pretty solid set of sales despite the continuing rise in inflation hurting pockets.

Over here in the UK, we have unemployment released tomorrow, followed by the latest inflation on Wednesday and Retail Sales on Friday. By the end of the week, a clear picture of the UK’s economy should have emerged.

The key question that will be answered is whether price rises have continued to slow in the UK. Indeed, there is a chance that inflation in the UK has fallen to the Bank of England’s target for 2024 of 3.75%, months ahead of when they expect it to be at that level.

Hitting its target so early would present the Bank with a difficult decision on whether the data is a blip or part of a trend and whether to cut or hold interest rates. Aside from economic data in the UK, it will be worth keeping an eye on Westminster, where Rishi Sunak faces a tough week trying to get his Rwanda bill passed, and BoE Governor Bailey faces a grilling in the House of Lords—all to play for in what promises to be an interesting week for the pound.

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

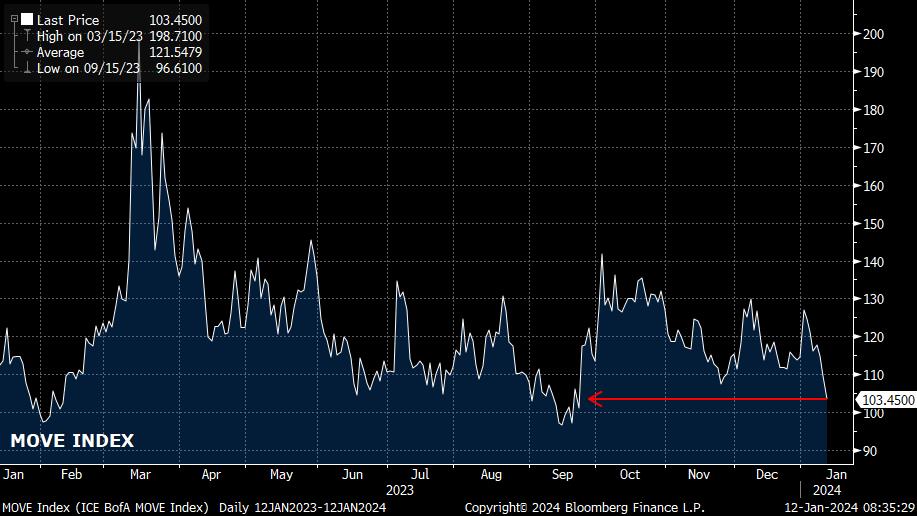

The start of 2024 has seen a notable slump in fixed income volatility, with BofA’s MOVE index – a measure of implied vol in the Treasury market – having now fallen to its lowest level since the third quarter of last year. This move catches the eye, not least owing to the increasing pushback from 2024 FOMC voters, including Barkin and Mester, on the idea of the first 25bp rate cut being delivered in March. Of course, this decline in implied vol also comes at a time when data points to the possibility of inflation making something of a resurgence, with ‘supercore’ US CPI having been practically unchanged around 4% for the last 6 months, in addition to geopolitical risks in both Ukraine and the Middle East remaining elevated. Perhaps, financial markets have become just a little too complacent.

Michael Brown, Market Analyst at Pepperstone

The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.