On the Spot: End of a Busy Week

Market run-through

The Fed and Old Lady came to the stage last week with markets on tenterhooks waiting for a surprise, and as if in concert, they delivered everything but a surprise. As expected, there were no changes in interest rates and the prospect of higher for longer was reinforced once again. Whether they both will need to raise rates again is most definitely in the balance. Firstly, the Fed is relying on the US Bond market to do the “heavy lifting” that, in reality, fiscal policy should be doing, which so far has been working. The premise that higher long-term rates temper Main Street’s spending is true, but sooner or later, bond rates will drop as spending dries up, and then what? A tricky path for Jay Powell to tread, and unsurprisingly he left the door ajar for more tightening. His opposite number in the UK, Andrew Bailey, also has issues to confront. With public and private sector salaries still roaring ahead, his concern should be that the UK gets into a wage push inflation cycle and interest rates have to rise more.

On Friday, we saw a slightly softer than expected Non-Farm Payrolls contained in a report that should hearten the Fed as it bears all the hallmarks of a soft landing for the economy. A gentle recession would be the ideal, and to be honest, surprising, outcome after the sharp rises in interest rates that we have seen. The dollar softened on the data, but with the situation in the Middle East still so volatile, its setback is likely short-lived. After the plethora of Central Bank meetings and data last week, we have little on the data docket to excite, with the highlight likely to be the release of the UK 3rd Q GDP on Friday. Without a doubt, there will be plenty of Central Bankers speaking, but sadly, the markets will primarily remain in headline-watching mode as events in the Middle East unfold.

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

We have definitely seen bullish momentum in the month of October. A lot of traders have been monitoring the crypto market closely over the past week especially, as we’ve seen rallies in major coins like BTC and ETH. Not only them but XRP has also rallied 22% over the past week ahead of the Ripple Swell conference. BTC sits in and around 35,000 USD, but close attention is on ETH as we sit around the 1,900 USD mark. If we cross the key psychological level of 2,000 USD, this can spark some much-needed volume.

USDT/USD continues to trade above parity, which has certainly presented some opportunities for those looking to liquidate. USDT/EUR and USD/GBP have been falling on the back of EUR/USD and GBP/USD strength. The FOMC meeting last week saw rates held by the Fed twice now, with Chair Powell hinting at a pause on what has been very aggressive tightening over the last few months. We have seen this and other market data result in market rallies.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

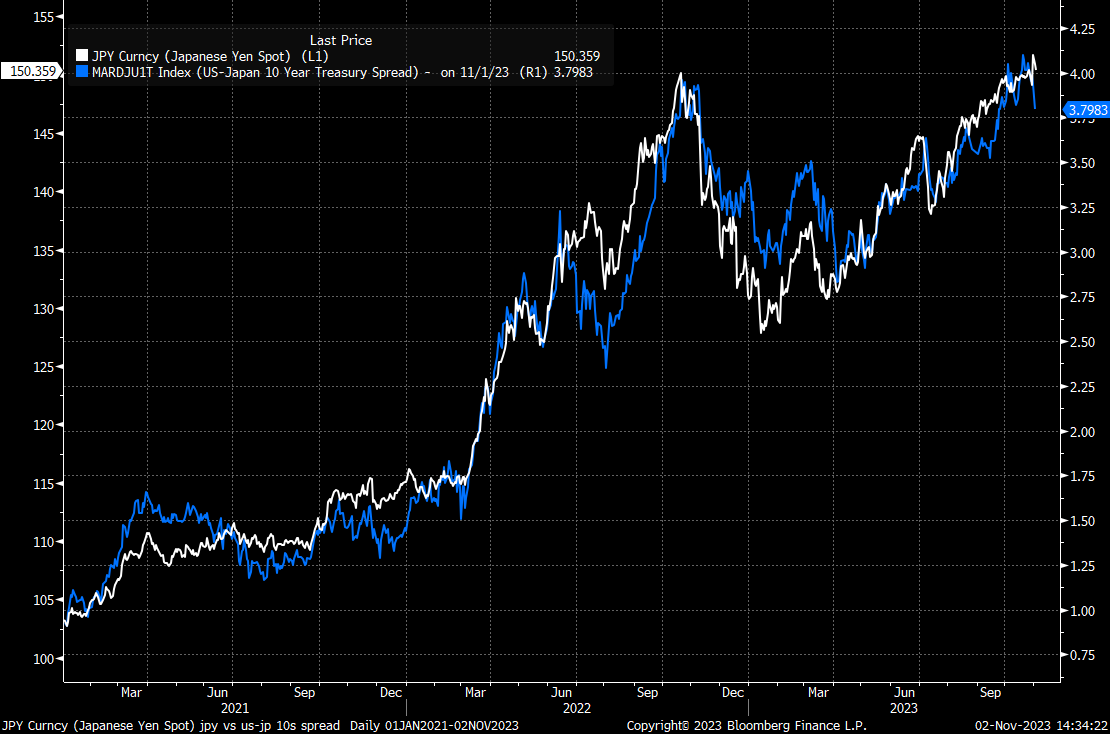

Is this the week that Treasuries, and the JPY, started to turn? The BoJ abolishing the hard upper limit on 10-year JGB yields, coupled with a lower-than-expected borrowing figure as part of the Treasury’s quarterly refunding announcement, and what the market took as a dovish FOMC meeting, have seen the bulls wrestle back control of the long end of the curve. With supply concerns seemingly allayed for now, some near-term relief may be on the cards for bond and JPY bulls, given the uber-close correlation between the two.

Michael Brown, Market Analyst at Pepperstone

The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.